Match each situation with the fraud triangle factor and delve into the intricate interplay of opportunity, pressure, and rationalization that drives fraudulent behavior. This comprehensive exploration unveils the complexities of fraud, empowering you with the knowledge to identify, mitigate, and prevent these costly and damaging acts.

As we delve into the nuances of the fraud triangle, we will uncover real-life case studies, analyze red flags, and develop strategies to safeguard organizations from the perils of fraud.

1. Match Each Situation with the Fraud Triangle Factor

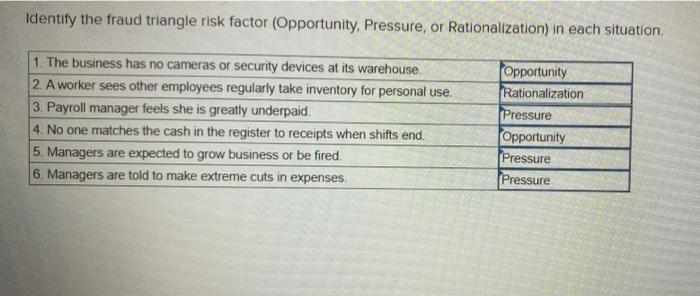

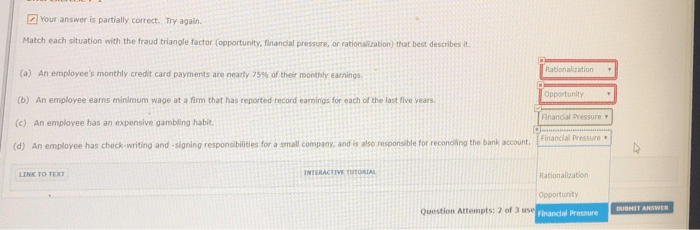

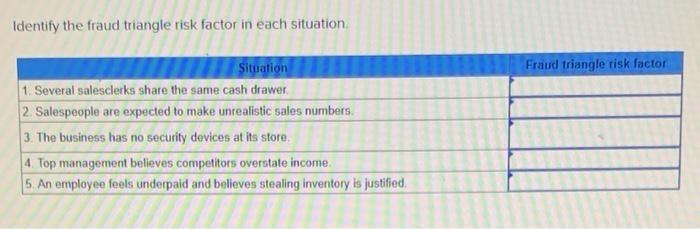

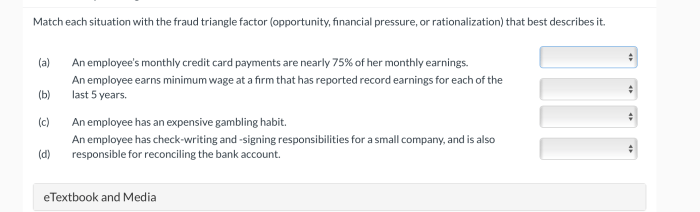

The fraud triangle is a conceptual model that helps explain why individuals commit fraud. It proposes that three factors must be present for fraud to occur: opportunity, pressure, and rationalization.

Opportunityrefers to the situation or environment that provides an individual with the chance to commit fraud. This includes factors such as weak internal controls, lack of supervision, or access to sensitive information.

Pressurerefers to the internal or external forces that motivate an individual to commit fraud. This can include financial pressures, such as debt or the need to meet performance targets, or personal pressures, such as the desire for recognition or status.

Rationalizationrefers to the way in which an individual justifies their fraudulent behavior to themselves. This can involve convincing themselves that the fraud is necessary, that they are not harming anyone, or that they deserve to benefit from the fraud.

| Situation | Opportunity | Pressure | Rationalization |

|---|---|---|---|

| An employee embezzles funds from their company by creating false invoices. | Access to sensitive financial information | Financial pressures | Convincing themselves that they need the money to support their family |

| A manager falsifies sales figures to meet performance targets. | Weak internal controls | Pressure to meet targets | Justifying the fraud as necessary to save their job |

| A customer files a fraudulent insurance claim. | Lack of supervision | Financial pressures | Convincing themselves that the insurance company owes them money |

| A vendor submits inflated invoices to a company. | Weak internal controls | Financial pressures | Rationalizing the fraud as a way to make up for losses |